Foundation financials

|

Progress Report 2021/22 |

When it comes to the health of children, our work is not done.

The size of the battles still left to fight requires funding of equal measure. That’s why we are so grateful for your commitment to our quest to conquer childhood illness—because the progress that’s being made is only possible through the collective power of your generosity.

As a nationally accredited charity under Imagine Canada’s Standards Program, we are committed to accountability and transparency with our donors in how funds are received, invested and distributed.

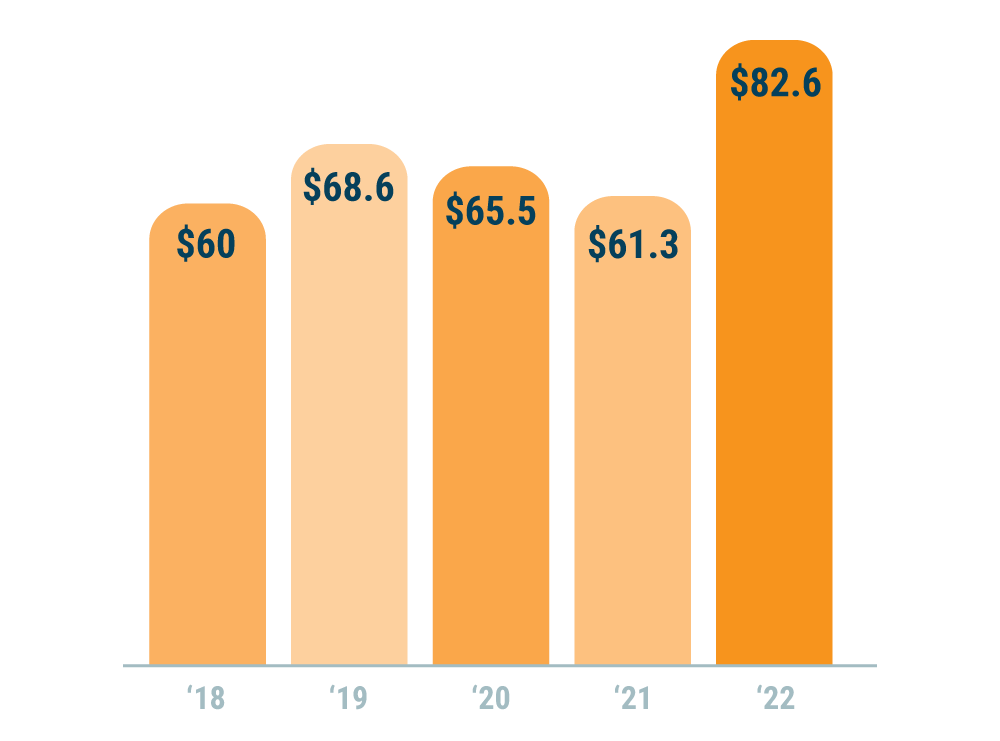

Fundraising revenueIn millions |

|

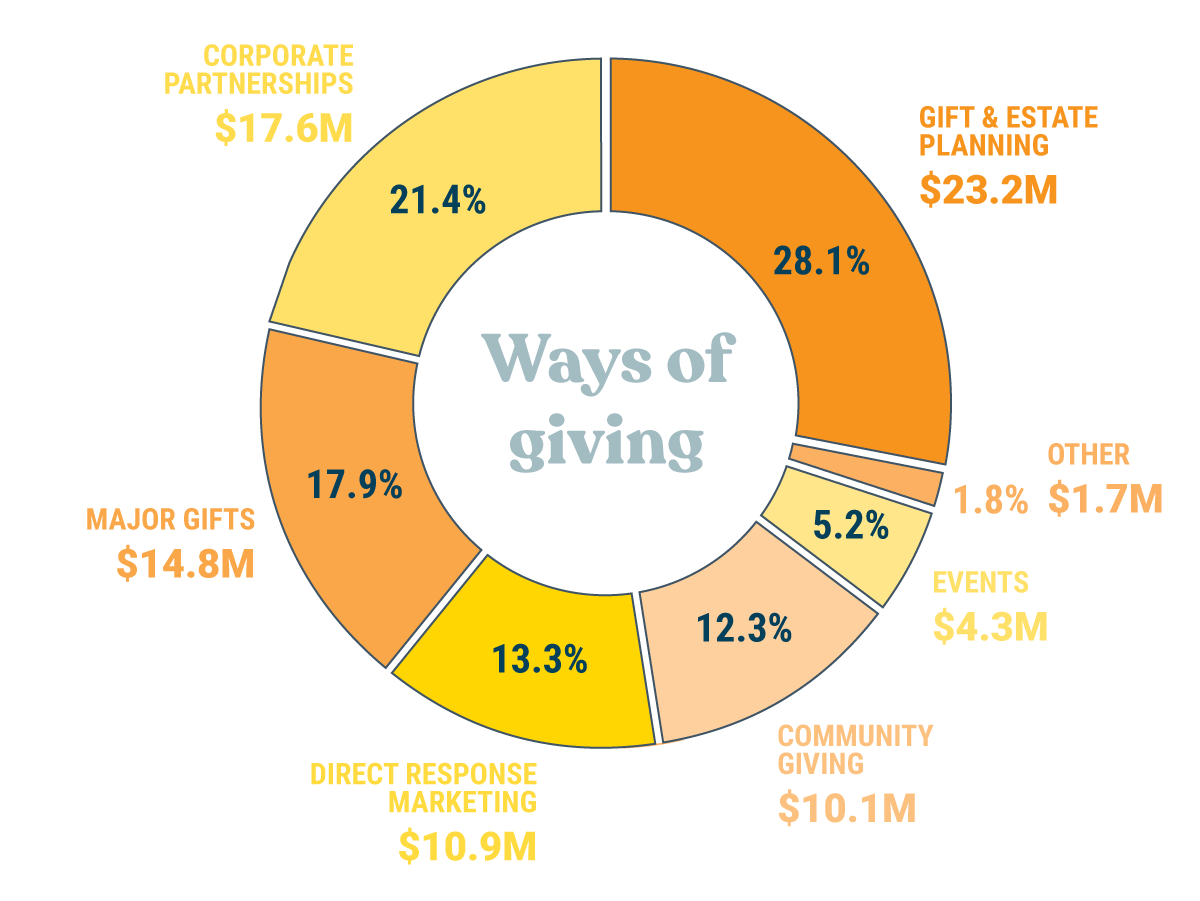

Sources of revenueIn millions

|

|

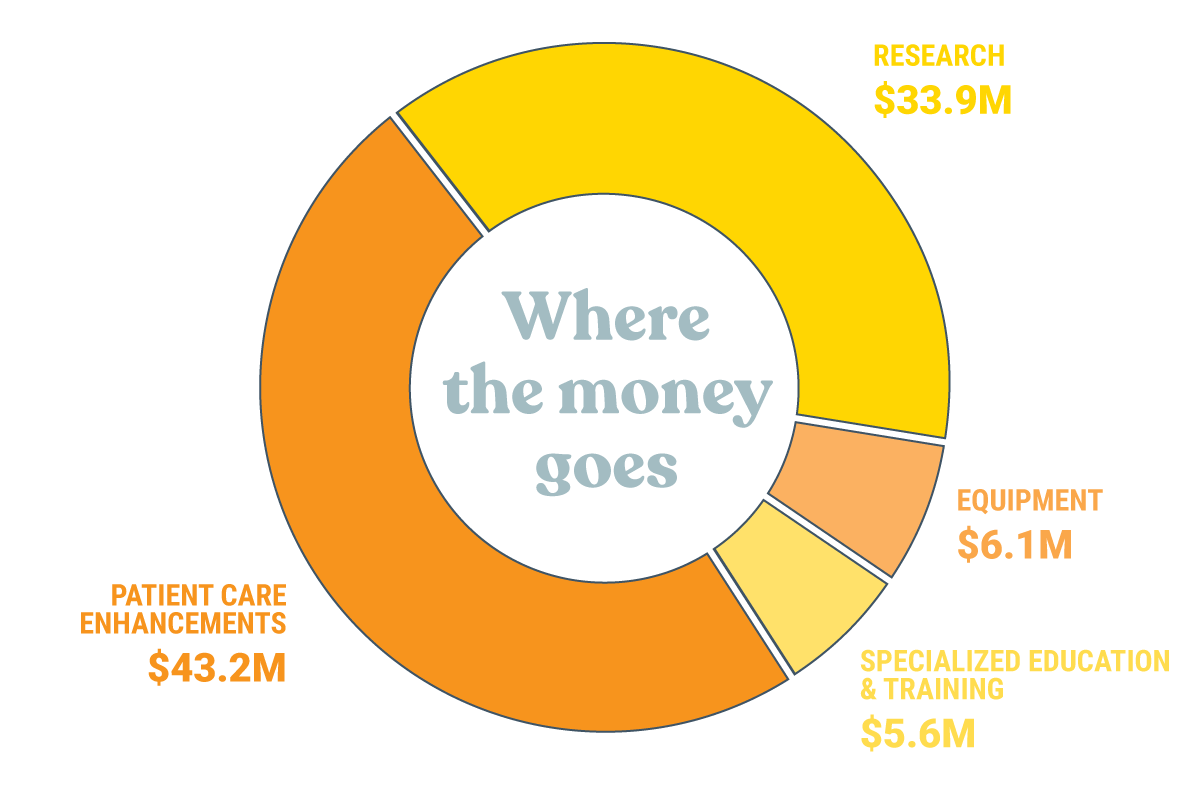

Areas of distributionIn millions |

|

Investment income & asset management |

|

In fiscal year (FY) 2022, the Foundation’s investment income, including fair-value adjustments, was $36.5 million, compared to $70.5 million in FY 2021; this translates to a rate of return of 8.4% after fees. FY 2021’s strong investment income was due to the pandemic bounce-back observed in overall equity markets. FY 2022 was much stronger than our expected portfolio return although it was much lower than FY 2021. BC Children’s Hospital Foundation’s Board of Directors, through the Finance & Investment Committee, oversee the governance of the investment assets by regularly monitoring the performance of the investment managers, selecting, appointing and releasing managers as required and deciding upon the appropriate amount of investment risk. |

Investment assets with the right asset mix are vital to ensuring stable and sustainable donor contributions to BC Children’s Hospital. Some of the larger investments made by the hospital are multi-year projects and it is critical that the funding is protected from inflation. We prudently invest donor funds through a well-diversified asset-mix portfolio with a number of investment managers. A significant portion of our investment assets are endowment funds that are externally restricted contributions made by donors. On an annual basis, the Board approves the endowment payout rate (4.93% for FY 22) based on the performance of our investment portfolio. These funds continue to provide an important base of ongoing and reliable funding for child health initiatives at BC Children’s Hospital. |

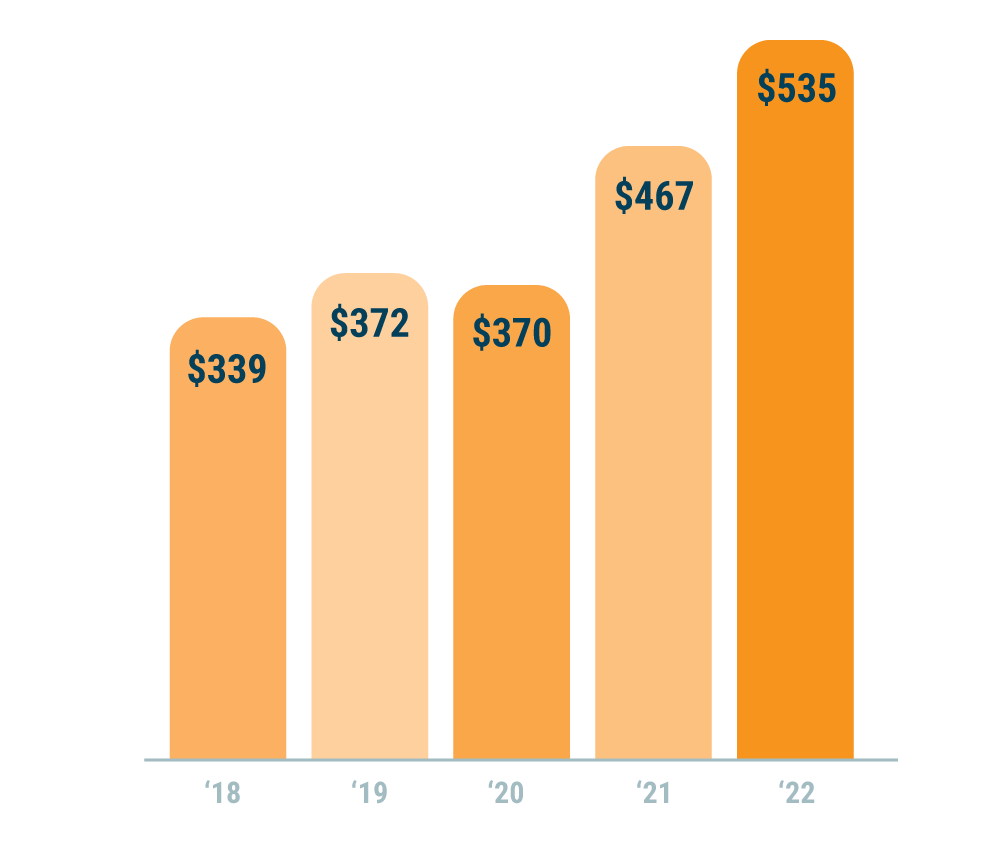

Total assetsIn millions |

|

You can view our complete set of audited financial statements at bcchf.ca/financial-statements or contact us at 604.875.2579.